A Child Champion in Kenya is building trust and changing the attitudes of men in her village as she helps them form savings groups, an activity normally left to women.

Child Champion Gloria has convinced men in her community to learn about money management through savings groups.

“Always know that you are the change that this world has been waiting for,” says Gloria, a tenacious Child Champion in Kenya. “Despite your gender or where you are from, always know that you carry with you a spark that can transform a community and this world.”

Gloria lives out those words with determination, crossing traditional barriers and winning the respect of elders in her community.

Growing up in poverty in a remote village in Kajiado, Kenya, Gloria had a great interest in learning and understanding money. She says from a young age she knew she wanted to pursue a career in business or finance.

“I loved numbers and my favorite subject in primary school was mathematics,” she recalls.

When she was in grade six, she says one of her teachers inspired her to dream about becoming an accountant.

“I remember my teacher asked me about my favorite subject, and when I told her that I loved mathematics, she told me that I could become an accountant if I wanted to because accountants are good with numbers,” she says.

Gloria had to take on adult responsibilities in her family at a young age.

So it was no surprise that after high school, Gloria went on to pursue a diploma in accounting and later graduated to become an accountant.

She got her first job as an accountant in a hotel before joining Olooltepes Hope Center in Kajiado in 2021 as a bookkeeper and the leader of the center.

Taking on Big Responsibilities Early

Gloria grew up in a large family. Her father had two wives and together they had 14 children. Gloria’s mother was the second wife, and at her time of death, she left behind five kids.

Being her mother’s third born, Gloria had to take on some roles in helping care for her two young siblings. At the time of her mother’s demise, she was in her third year in high school.

She says she had to forfeit school for two months to help her younger siblings cope with the loss of their mother. It is at that point when she was 16 that she realized she had a soft spot for kids.

In addition to taking care of her younger siblings, Gloria also served in the Sunday school in her church in the village. Years later when her father died, Gloria and her older siblings had to struggle to get the younger ones through school.

Gloria helps kids at their Hope Center.

This meant that she had to miss school at times to work so that she could pay her brother’s college fees and also pay for her own school fees.

When an opportunity to serve kids in her own community through the Hope Center came up, she was delighted to apply for it.

She says it was a perfect time for her to inspire kids in Olooltepes village because she understands the struggles of children in her community.

Finding Solutions to Poverty

As 2021 came to a close, Gloria received an invitation from the OneChild field office in Kenya to be part of a training by The Chalmers Center, a partner of OneChild.

Chalmers is an organization that partners with churches and other organizations through which they empower communities to learn how to eradicate economic poverty.

In the training, the Chalmers savings group idea was introduced.

Savings groups are common in Kenya, but the Chalmers savings group is different because it incorporates biblical yet practical solutions to poverty, unlike the common groups that do not involve any spiritual aspects.

After Gloria won the trust of men in her community, she convinced them to join a savings group.

After the training, all participants were urged to share the knowledge they had gained with the parents of the registered kids at the Hope Centers and hopefully urge them to form savings groups.

When Gloria went back to her Hope Center, she sought to understand the history of savings groups in the community.

She realized that there were numerous groups in the village.

Some were thriving, some were struggling, and some had collapsed. But one common thing about all the groups in her community is that they were made up of women.

Enticing Men to Join Savings Group

After understanding the dynamics of groups and learning from their failures and challenges, Gloria made up her mind to urge the men to form a savings group.

“It is a challenge I took upon myself,” she says. “I wasn’t sure if the men in the community would buy my idea, but I was determined to give it my best. I believe that men, too, can be part of the groups that help empower the whole community. It is one thing to be part of a process and another to support it from a distance. Our men have been doing the latter.”

Thanks to Gloria, the men in her Maasai community opened their minds to learning about money management in savings groups.

When the new year came, the Hope Center called for a parent meeting in February. Gloria shared her idea with the leadership at the center and she was allowed to discuss it at the meeting.

As the meeting was concluding, she shared the idea with all the parents and left it open for the men who were willing to be part of the initiative to meet her later in the day.

Her idea was met with cheers and clapping from the parents.

“After the meeting, I was surprised that some men bought the idea, particularly the elderly ones. We met and began the registration of members. Then we set a date for our introductory meeting, and that is how our group of 13 men picked up,” she recalls.

Breaking Gender Taboos

According to Gloria, the idea that men from her community, the Maasai, could form a savings group was unheard of because it was thought to be a women’s thing and the defined cultural roles in the community did not allow one gender to be involved in matters that were perceived to be for the other gender.

“It would be odd to see a man sit in a meeting with women to discuss finances and savings. In fact, it is unheard of because in my community, the gender roles are clearly defined, and no gender is allowed to participate in activities that are perceived to be of the other gender. Savings groups happen to be a women thing,” she says.

She adds that most men in her community are impatient and are not informed on how money works.

“For example, if you tell a man in my community to save $2 and that after some time, it would have gained interest, they will not buy into the idea because they would rather have the money do something impulsive than save it for the future.”

In addition to starting up men’s savings groups, Gloria also manages several women’s savings groups.

Also, there is a general notion that women are faithful to repaying the loans they take from the groups and are less likely to flee with the funds, as opposed to men who are generally thought to be otherwise.

However, Gloria won the trust of the members. She guided the group on how to set rules that govern it, including ways on how their funds can be safeguarded even when they are loaned out to members. This helped take away the fear of members losing their money.

“I realized that for you to be impactful in a community, it calls for wisdom on how to apply the knowledge one has acquired,” Gloria says. “Having understood the norms in my community, I knew how to respectfully relate with the men, and this has, in turn, made them love and respect me. It is even easier to manage this group because of how much they respect me.”

Good Transformation in the Community

Simon, the chairman of the group, says that their lack of knowledge was the major reason why they didn’t know how to make a savings group work.

“Knowledge is power, but it also takes humility to gain knowledge,” he says. “We’ve seen what Gloria does with the kids at the center and how she has transformed this community by caring for our children. So this is why when she brought forth the idea, we easily trusted whatever she told us, because if you can trust someone with your child, why would you not trust their knowledge of something?”

He explains that they were motivated to move away from being passive supporters of ideas that can transform the community to being active participators.

“It is common to see men allow their wives to attend meetings of the groups, and most of the men even support them by giving them money that’s required by the different groups. But never will you find them joining the groups, so our group has really helped us know how better we can relate with resources in our community so that we can make the community self-sustaining. This will help boost the effort by the women,” he explains.

He is optimistic that when their group succeeds, other men will be encouraged to also embrace the idea. Simon adds that over the short period that Gloria has been a Child Champion at the center, she’s become an epitome of good transformation in the community.

“Most of us in the group are elderly,” he says. “Gloria is the youngest, and also the same age as some of our grandchildren. But it brings us so much joy to know that our children, Gloria included, are the change that our community has been waiting for. We all wish that after sending our kids to school, they can come back and transform the community like Gloria is doing.”

Curriculum Empowers and Educates

The group meets weekly, and Gloria helps explain their savings results to them because most of the elderly men are illiterate.

In addition to helping form the first-ever savings group of men, Gloria has also trained six other women’s savings groups from other Hope Centers on the Chalmers curriculum. The groups are up and running.

“The Chalmers curriculum has helped empower us and we are now learning important aspects of identifying resources in our communities and also learning how to utilize and save money,” says Gloria.

“We now have a better understanding of how we can bring our resources together, do investments and in the process eradicate poverty in our families and communities, and as the kids learn from us, the eradication can spread globally.”

Gloria’s hope for all kids in hard places is that they become the hope that their community has been waiting for. And she’s putting her hope into action by serving as a living example to them.

Help us open more Hope Centers to reach more kids in hard places by giving to the OneChild Partners Fund today!

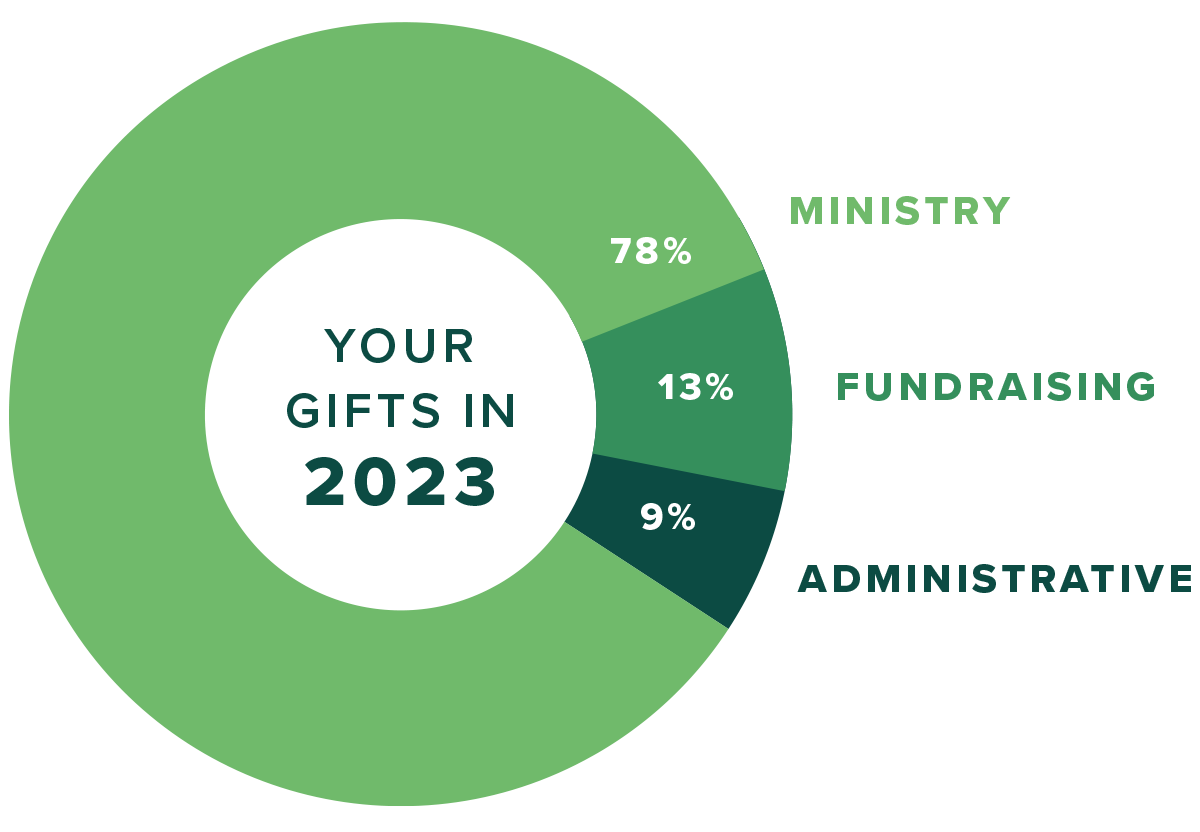

We are accountable to the children we serve AND to our donors.

Our accountability to our donors is one of our highest priorities. Our goal is to use the funds entrusted to us as wise stewards. To do this requires continued monitoring of our fund distribution. OneChild is also a member in good standing with the Evangelical Council for Financial Accountability (ECFA)